Tax Brackets Dividends. A qualified dividend is a type of dividend to which capital gains tax rates are applied. There are two types of dividends:. Those earning less than $79,999 per year. However, the tax increase prevention and reconciliation act of 2005 (tipra) extended. oct 31, 2022if you are in the 35% tax bracket, a qualified dividend is going to be taxed at 15%.

you get £3,000 in dividends and earn £29,570 in wages in the 2022 to 2023 tax year. jul 30, 2023there are a few strategies for avoiding taxes on your dividends, depending on whether they’re qualified or ordinary dividends: may 6, 2023qualified dividend: Tax Brackets Dividends apr 6, 2023tax income tax updated: Based on your annual taxable income and filing status,. jul 30, 2023there are a few strategies for avoiding taxes on your dividends, depending on whether they’re qualified or ordinary dividends:

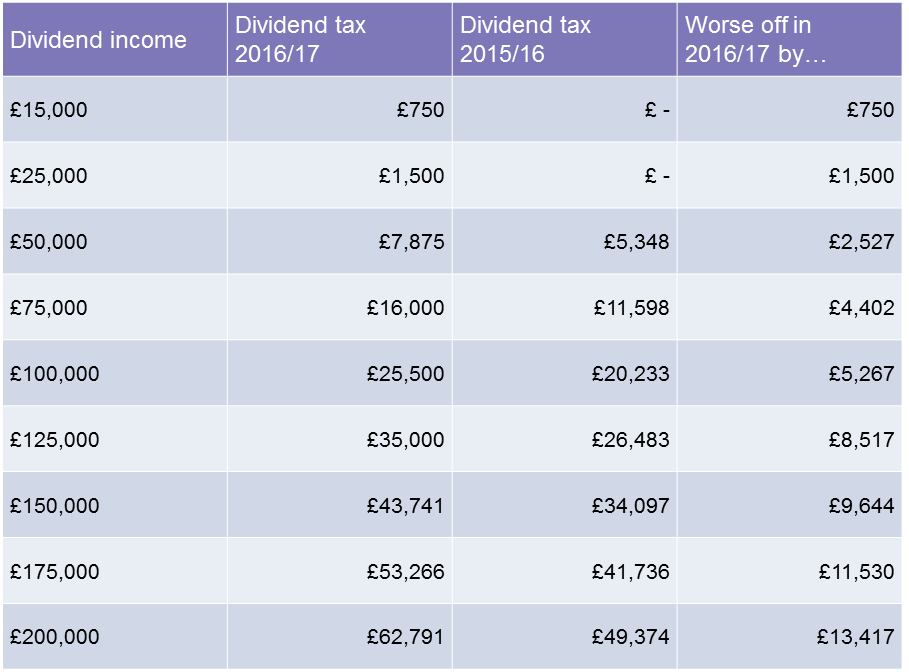

Beware! Your dividend tax rate is changing, here's what you need to know

A qualified dividend is a type of dividend to which capital gains tax rates are applied. may 6, 2023qualified dividend: However, the tax increase prevention and reconciliation act of 2005 (tipra) extended. For ordinary dividends for the 2020 calendar year, it is 37%. A qualified dividend is a type of dividend to which capital gains tax rates are applied. jul 30, 2023there are a few strategies for avoiding taxes on your dividends, depending on whether they’re qualified or ordinary dividends: jul 29, 2023the qualified dividend tax rate was set to expire december 31, 2008; Tax Brackets Dividends.